Excerpt from www.NDMA.COM, © 2026 N. Dean Meyer and Associates Inc.

Executive Summary: The Internal Economy

market-based financial/resource-governance, including budgeting, service catalogs, cost modeling, project intake and priority setting (demand management), and chargebacks

by N. Dean Meyer

Resource-governance processes include:

Together, these processes determine how money flows through the organization and what work gets produced, for whom, when.

They address challenges such as budgeting, cost control, prioritization of demands, managing expectations, trust through financial transparency, understanding of value delivered, and financial benchmarking.

A Story Illustrates the Problem

In your town, it's up to your grocery store manager to get enough budget to pay his bills.

Each year, he submits a budget to the Town Council. His budget forecasts how much he'll need to spend on rent, electricity, compensation, etc., based on trends in past year's costs.

The Town Council is skeptical of his argument that he needs the money simply because that's what he spent in prior years. They challenge his costs for training and additional check-out staff, hoping to bring down your grocery bills.

Finally, they decide on a budget -- less than the manager requested -- and challenge the store to "do more with less."

The town then taxes you to collect money for the grocery store. The tax is based on the number of people in your household (a reasonable predictor of grocery costs).

You resent this uncontrollable expense, and join your neighbors in claiming that the grocery store costs too much.

But you need food; you go to the store to shop.

As a customer, you have no idea what the grocery store's budget covers. To you, everything is free. And since you've paid your taxes, you want to get your fair share. So, you demand every luxury. And it's that manager's fault that the store can't deliver everything you want.

Reality: Traditional Approaches Create Serious Problems

Absurd, you say!

But wait.... If you lead an organization that provides products and services to others within your company -- an "internal service provider" -- you are that grocery store manager and this might be your reality.

Traditional resource-governance processes work something like this:

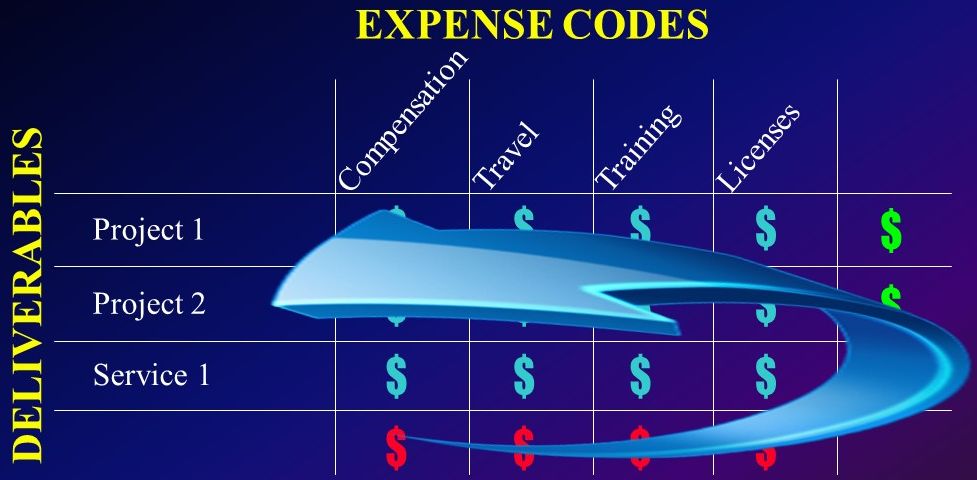

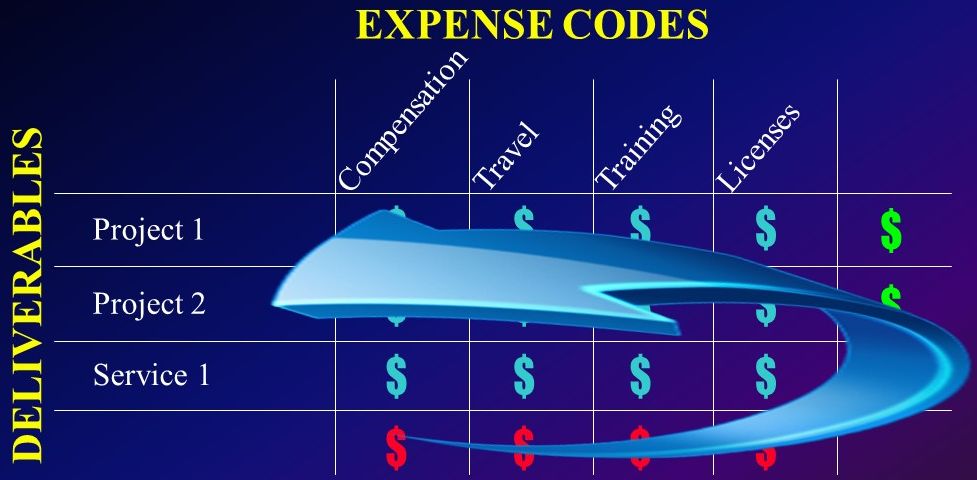

- You propose and defend your budget, with minimal input and support from your internal clients. Your budget is a forecast of what you plan to spend (compensation, travel, training, vendor services, etc.). That's not something your clients can validate.

- Executives see how much you cost, but don't see the value they'll get for the money. So they focus on minimizing your spending.

- Executives micro-manage you by cutting specific costs, like travel, training, etc. (What else have you given them to talk about!?) Or they make unreasonable demands (e.g., "do more for less") for lack of better levers on costs.

| "Dean is a world-class expert on... financial management. He goes far beyond a surface understanding of the topic, with deep and nuanced insight into the organizational and political dynamics surrounding it." |

Charles Betz

Research Director, IT Portfolio Management, EMA |

- Executives don't have the data they need to make optimal budget decisions -- they don't know what you'll deliver for various levels of funding. So they're forced to allocate budgets based on past years' spending and politics rather than next year's business needs.

- As a result, you're forced to accept less than you asked for -- less than you know you need. Your budget may not be sufficient to fund important projects and services.

- With operating costs rising year-over-year and budgets relatively flat, you have less and less each year for strategic projects.

- Your internal clients think your services are free (at least to them), so they demand everything they want.

- Your staff are under pressure to deliver more than their time and resources permit. So, they sacrifice their training, innovation, process improvements, and other critical sustenance activities. Your organization becomes less productive and less innovative, driving future costs up.

- Despite staff's efforts, clients still aren't satisfied. They blame you for failing to satisfy their needs, because you can't produce unlimited products and services with finite resources.

With clients' demands far exceeding your resources, you need a demand-management process. Traditional approaches include:

- First-come, first-served, which has little relationship to business imperatives.

- A steering committee that rank-orders major projects. But they don't know "where the line is drawn" -- what will and won't be feasible with current resources. So they go on expecting it all, and the steering committee only serves as a forum for their discontent.

- Bureaucratic hurdles, like demanding that clients justify to you why they should have the right to buy from you. This may succeed at discouraging requests that aren't important to clients. But you antagonize clients by becoming difficult to do business with, damaging a partnership that's essential to your success.

- Taking it upon yourself to decide what will and won't be approved. This sets you up as an adversary -- a hurdle that clients must overcome, not a valued partner. Meanwhile, your decisions may not be optimal, since you're not as well equiped to know the value of your deliverables to clients' business as are your clients.

- Studying enterprise strategies and generating projects you feel are strategic. This makes you the sponsor of your own work. Even if you're right, clients resist when you attempt to force your solutions on them.

The results: Clients feel they can't control your priorities, and view you as unresponsive to their needs. They may unfairly believe that you cost too much, are misusing your budget, or are failing to deliver value.

Furthermore, resources don't always flow to the most pressing needs.

And for your staff, there's little to encourage customer focus, frugality, or innovation.

Traditional fiscal controls emphasize capping your spending:

- You are held accountable for controlling the costs of your function. Even if clients are willing to fund additional high-payoff projects/services, your job is to challenge them and resist spending increases.

- Your managers are accountable for spending no more than what was in the budget. They're reluctant to grow their businesses and deliver additional services, even when clients are willing to pay the costs, since that would involve spending more than planned (an explainable variance), or recouping only direct costs and further burdening your support services.

- Your staff might have innovative ideas about how they can better serve the business. But they're reluctant to bring them up for fear of being asked to deliver more without additional resources.

The result: Leaders think about managing the resources they've been given, not running entrepreneurial, customer-focused internal businesses.

Meanwhile, clients are unable to buy what they need from the internal service provider, so they work directly with vendors or their own decentralized support groups.

In some cases, your CFO may demand that you assign your costs to client business units, to help Finance with cost accounting. There are two ways you might "spread your costs to the business":

- High-level formulas for allocations have little to do with consumption; they don't change buying behaviors or mitigate demand. The only way clients feel they can control these charges is to micro-manage your spending. And allocations remind clients of how expensive you are, but they don't build an understanding of the value you deliver.

- Usage-based chargebacks can be costly to administer. And if your rates aren't accurate, for example if they include enterprise-good services that vendors and decentralized staff don't have to deliver, they could inappropriately induce outsourcing and decentralization.

List of the most common symptoms of resource-governance problems....

The Alternative: Internal Market Economics

There is another approach -- internal market economics -- which provides all the same controls and also addresses resource-governance challenges in a far more effective manner.

Consider the fundamental purpose of resource-governance processes: to allocate an enterprise's scarce resources (money, time and assets) to the purposes that need them the most.

"Market economics is the

most powerful mechanism of social coordination

known to mankind." |

Dr. Charles "Ed" Lindblom

professor emeritus of political science and economics

Yale University |

In the real world, that's exactly what an economy does.

Internal market economics designs resource-governance processes based on principles of market economics.

Your organization is viewed as a business within a business. The enterprise doesn't give you money (budget, chargebacks, or allocations) to pay your costs, any more than you give your grocery store money to pay its rent, utilities, and compensation expenses.

Just as you give the grocery store money to buy food, your organization is given money to "buy" your products and services.

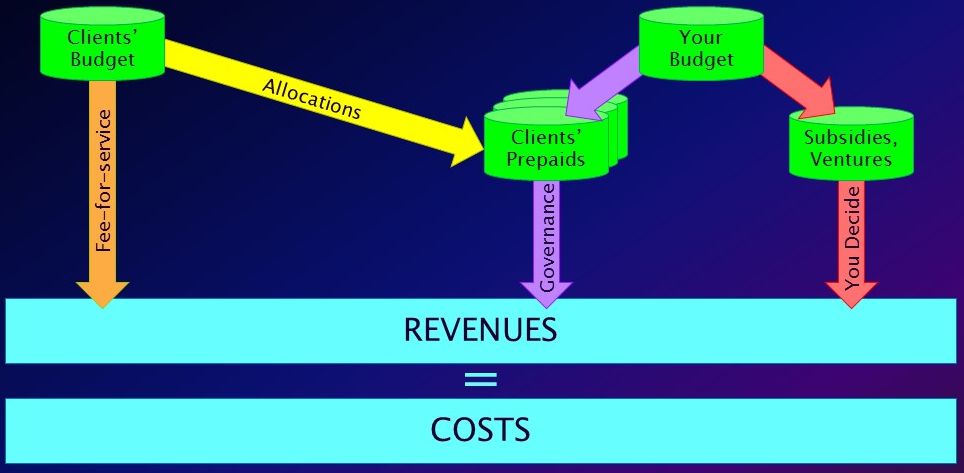

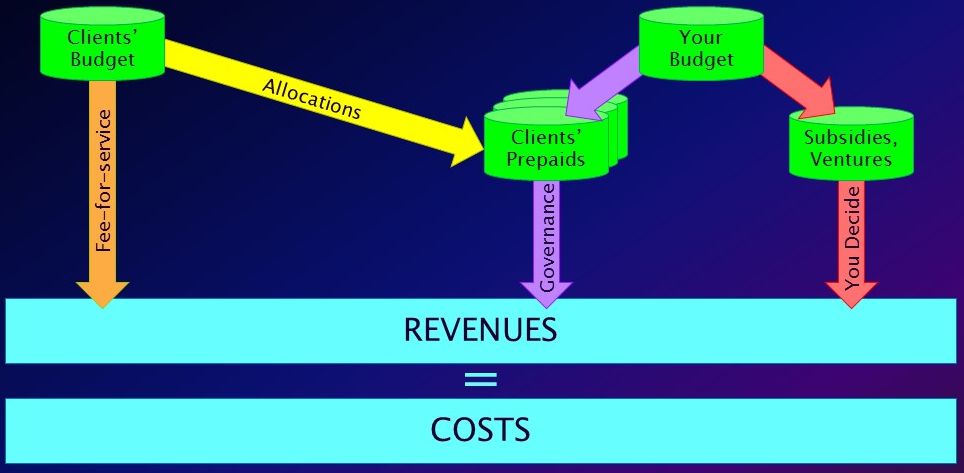

In the case of fee-for-service chargebacks (rates for individual purchases), this is obvious. But what about direct budgets and allocations?

Key concept: With internal market economics, budgets and allocations are treated as pre-paid revenues -- money put on deposit with you to buy your products and services in the year ahead.

Note that treating budgets as pre-paid revenues implements market economics without money changing hands:

- Spending power belongs to clients (even if you receive budget directly). Clients decide what they'll buy from you, within the bounds of a finite checkbook.

- Your job is to be their supplier of choice, but not to control them.

When you treat your budget as pre-paid revenues, the process works quite differently:

How It Works: Investment-based Budgeting

- You submit a budget that describes the cost of the products and services you propose to deliver (your planned deliverables, not just your planned spending).

Deliverables include not just they projects and services you think the enterprise can afford, but also all the requests clients have made and might make.

This is termed "investment-based budgeting."

- The enterprise budget process decides your total budget by considering the payoff of proposed deliverables

Clients naturally defend the projects and services that benefit them. And you'll leave the budget process with a clear understanding of which projects and services your budget does (and does not) pay for.

More on investment-based budgeting....

How It Works: Demand Management (Governance)

- You separate out budget for enterprise-good activities like policy coordination (subsidies), and for investments in your organization such as infrastructure and major process improvements (venture funding).

That leaves the bulk of your budget for client deliverables.

This portion of your budget is treated as pre-paid revenues. It goes into a "checkbook" that clients use to buy your products and services throughout the year.

- If you get allocations (high-level formulas that transfer money from clients to you), these too can be treated as pre-paid revenues.

This is quite different from the common view of taxing clients to pay your costs. Clients generally support allocations when they're in control of the resulting checkbook, and see the value they get for their money.

- A governance process designates a "purser" (often a committee) to manage that checkbook.

You communicate the full cost of all your products and services, and pursers decide what they'll buy.

- If a client wants something, he/she makes a case to the purser, who may choose to adjust your priorities.

That failing, the client can find other sources of funding, and pay you directly (fee for service). As long as he/she is willing to pay the full cost, you can expand your capacity (e.g., with contractors and vendors) and satisfy the incremental demand.

More on demand management (governance)....

Benefits: Markets Work Better than Bureaucracies

Internal market economics replaces burdensome bureaucratic controls with sensible, and more effective, market-based processes.

Costs are completely managed through the combination of three controls:

- Clients can't buy more than they can afford (what's in their checkbooks, as determined by your budget, plus any additional funding they choose to provide). So demand is under control.

- Internal suppliers have to break even, i.e., they can't spend more than their revenues. So their spending is under control..

- Suppliers must control costs to offer competitive rates, which can be benchmarked.

| "Dean's work is phenomenal in the area of defining services, determining the resources behind each one, and focused on elevating the conversation throughout the business." |

Alan Payne

Navy Federal Credit Union |

And decision-making is improved:

Other benefits include:

- Perception of value: Clients understand the products and services they get from you.

- Clients defend your budget, since it ultimately becomes theirs to spend on your products/services.

- Managing expectations: Clients know that they can't expect what they can't afford. Thus, their expectations match your resources.

- Relationships improve: Your interactions with clients becomes transparent, businesslike, and not at all bureaucratic or political. This builds trust and improves collaboration.

- Sustainable business: You can build into your rates some level of reinvestments in your business (e.g., training, process improvements, relationship building), as long as you remain competitive. Thus, you can deliver your products/services reliably and maintain a viable business.

- Funding for infrastructure and innovation is explicit, not left to clients' largess or unreliable year-end money.

- The culture shifts: Staff learn to think like entrepreneurs running businesses; they become customer focused, and are frugal to keep their rates competitive.

Implementation: Three Subsystems

Internal market economics is implemented through three subsystems:

- Planning: annually before the fiscal year begins, the business planning process produces two results:

- Demand management (aka priority setting, project intake, investment portfolio management, "governance"): throughout the year, clients (who own the checkbook) decide what checks to write, continually adjusting priorities to match the ever-changing needs of the business.

More on project intake, priority setting, demand management....

- Accounting, reporting, invoicing, dashboards, metrics: the dynamic processes that operate throughout the year; includes:

More on accounting in internal market economics....

Implementation: Strategy

Key concept: There is a recommended sequence to the implementation of internal market economics:

- Planning is always the best first step. It delivers the most value at a relatively low cost. And it is prerequisite to the other subsystems, since it tells you the cost of your products and services (both in total in the budget, and the rates in your service catalog).

FAQ: Don't we need to get our historical data in shape before working on the planning process?....

Software, methods, and consulting to implement investment-based budgeting and service catalog with rates....

- Demand management is generally next. It delivers a significant amount of additional value, with minor additional costs.

Don't you need accounting systems to produce invoices first? If you "invoice" at planned cost rather than actual, you can harvest the benefits of client-driven demand management before you have to invest in long and expensive projects to build accounting systems.

Why not do this first? Getting this right depends on an investment-based budget, which defines what the budget was initially intended to pay for. This explains how to channel funds (pre-paid revenues) into checkbooks belonging to the various client business units (and a checkbook for investments in the organization itself). And it establishes the costs of your products and services. Both are prerequisite to effective demand management.

- Accounting systems, including invoices and reporting for both clients and internal service providers, generally come last. This is the most expensive and time-consuming of the three subsystems. And the incremental value it delivers is less urgent than the others.

Once all these subsystems are in place, an organization has a resource-governance system that has comprehensive controls; balances supply and demand; empowers consumers of internal services to choose what they buy; and encourages a culture of customer focus, accountability for results, frugality, and entrepreneurship.

|