| Excerpt from www.NDMA.COM, © 2026 N. Dean Meyer and Associates Inc.

Executive Summary: Investment-based Budgeting

forecasting the costs of planned projects and services, not just what you plan to spend

by N. Dean Meyer

Annual planning produces business (operating) plans and budgets. Internal market economics suggests a very different, entrepreneurial approach to both.

Traditional Planning ProcessesIn traditional processes, each department submits a budget to get money to pay its costs. The budget is a forecast of spending on expenses such as compensation, travel, training, and vendor services. This kind of budget just begs for micro-management. "Hey, you don't need all that training!" In truth, top executives really don't know how much training you need to run your business. But what else have you given them to talk about? Scrutinizing costs and driving efficiencies may be a legitimate discussion with one's boss, but it's inappropriate during budget negotiations. Budget planning allocates an enterprise's scarce resources among organizations. It should focus exclusively on deciding what value each organization will be funded to deliver, channeling scarce resources to the best investment opportunities based on business needs. This is not the appropriate forum to coach you on cost efficiency. Conversations about your management of your costs should happy separately, and continually, with your boss, not your customers. The traditional focus on costs has another unfortunate consequence. It induces a perception of costs without a concomitant understanding of value. This gives rise to a vague suspicion that you cost too much (even if you compare well to benchmarks like outsourcing rates). A back-and-forth on costs has yet another unfortunate side effect. It encourages managers to build a buffer ("fat") into their budget proposals, knowing they'll be challenged to reduce costs without any reduction in expected results. This doesn't necessarily lead to the right numbers; but it does confirm that your numbers can't be trusted. Another insidious effect is its damper on innovation. Managers may be reluctant to bring up new ideas, for fear of being expected to deliver more without additional resources. Perhaps the worst effect is that traditional budgets don't support sensible decision making. Scarce resources (money) should be allocated to the best investment opportunities. But there's no way to analyze ROI on compensation, travel, and training. Thus, executives are forced to make budget decisions based on factors other than business needs and investment returns, such as last year's spending or current headcount. This does not allocate scarce resources to the best returns. Once approved, traditional budgets provide no basis for demand management. Clients may say, "You got all that money, so why can't you do everything I want for free!?" And you have no way to explain what is, and what's not, funded by your budget. Also, traditional budgets don't support cost accounting. There's no way to know what portion of your budget should be allocated to each of the various business units that consume your services.

Investment-based BudgetingIn internal market economics, business and budget planning take a different form. As a business within a business, you don't get money to pay your costs. You're given money to "buy" your products and services. That insight leads to a different approach to budgeting. Key concept: In internal market economics, budgets don't just forecast what an organization would like to spend. Budgets forecast the costs of the products and services an organization might deliver in the coming year.

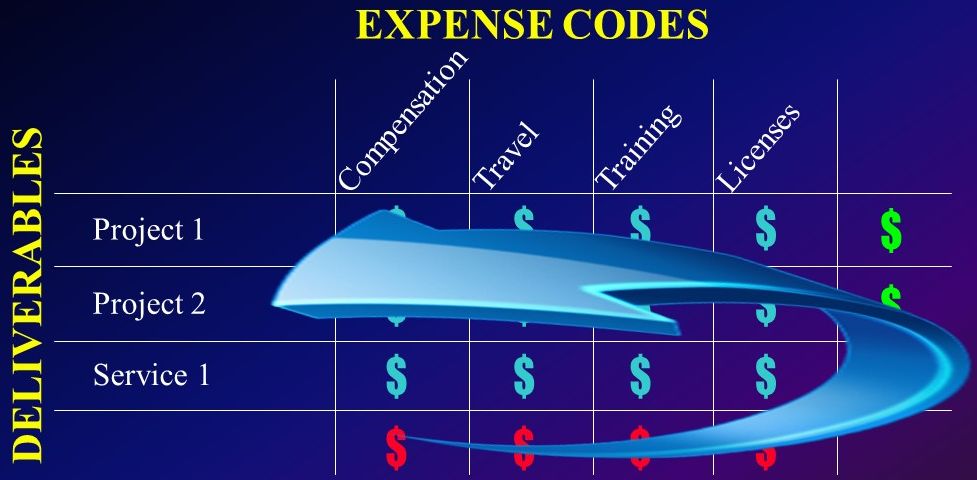

This is termed "investment-based budgeting." Picture a spreadsheet where the columns are general-ledger expense codes, and the rows are the projects and services proposed for the coming year. The key is to total the rows, not just columns. Note: Investment-based budgeting subsumes the concept of zero-based budgeting since all products and services are rows in the budget, and are subject to scrutiny. There is no "base" budget, a fixed sum for unknown ongoing services.

The Differences between Investment-based Budgeting and Cost AccountingInvestment-based budgeting has, at its core, a cost model that associates all costs with an organization's products and services. But it's quite different from cost accounting:

When the costs of the rows are visible in the budget process, there are many benefits....

Changes the DialogInvestment-based budgeting has dramatic impacts on the budget decision process. With an understanding of what various levels of funding will (and won't) pay for, budget decisions can be fact-based. Senior executives can decide what they'll "buy" from each organization with scarce enterprise resources, considering business needs, ROI, and enterprise strategies.

Specific benefits include:

In fact, internal customers can (and will) defend your budget by explaining their needs and the business value of your products/services. This is appropriate, since customers are the ones who suffer when your budget is cut -- they're constrained to buy less in the year ahead. And they're the ones who benefit from giving you a larger budget. Note that customers are more convincing since they're in the best position to know the value to the business of the supplier's work.

Investment-based budgeting illuminates three effective ways to cut costs:

Demand management is typically the most lucrative source of savings (since most organizations are reasonably well run and have already picked the "low hanging fruit").

If costs must be cut (downsizing), the enterprise has to be selective about the rows it funds. It fully funds the few things it chooses to do, and removes costs associated with everything else (rather than crippling everything with across-the-board cuts). Thus, expectations are reduced in conjunction with cost reductions.

The remaining projects either require other sources of funding or they won't be delivered. Specific benefits include:

Sustainable BusinessAn investment-based budget sorts out the costs of:

The benefits of sorting out these different types of costs include:

Data for Demand Management (Governance)The data in an investment-based budget provides the basis for a business-driven demand-management (governance) process -- a process that adjusts priorities throughout the year to align your organization with clients' ever-changing business needs and opportunities. Governance decisions require two kinds of information: what funds are available (what's in the checkbook), and what the various proposed projects and services will cost. Both of these facts come out of an investment-based budget. The approved rows in the budget explain which checkbooks get the funding -- checkbooks owned by specific business units, consortia, and the organization itself. They also reveal the full cost of projects and services known at that time. Additionally, this annual planning process updates the organization's catalog of products and services, and calculates fully burdened rates (unit costs) for each (using the same cost model that produces the budget). For projects that arise mid-year (and weren't costed in the proposed budget), these rates are used to estimate project costs accurately and consistently. Specific benefits include:

Cost Accounting and AllocationsAn investment-based budget explains who gets what -- the costs of projects and services delivered to each business unit. You know what each business unit is expected to consume. Specific benefits include:

Internal EntrepreneurshipGenerally, managers are engaged in the process of developing an investment-based budget. This experience teaches them to think like entrepreneurs. Specific benefits include:

The Enterprise PerspectiveFrom an enterprise point of view, there are additional benefits, especially when the practice is adopted enterprisewide:

Bottom LineInvestment-based budgeting allows better-informed budget and strategy decisions, explicitly aligns resources with enterprise strategies, defines accountabilities for deliverables, installs a discipline of frugality, enhances cross-boundary teamwork, and gives you a realistic view of product-line profitability. The bottom line: Investment-based budgeting enhances shareholder value. But investment-based budgeting is more than just the numbers.... It's a visionary way to run an organization.

|