| ||

|

PROJECTING SPENDING TRENDS

"Insanity: doing the same thing over and over again and expecting different results."

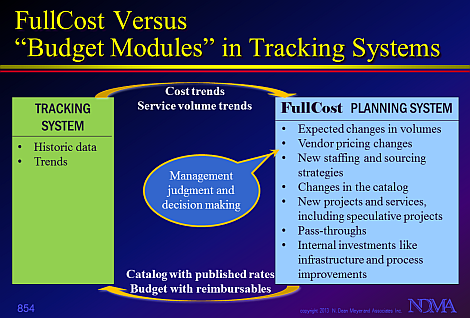

Many financial accounting and invoicing systems have a "budget module" which vendors claim can be used for budget planning. These systems provide trends in costs, and some provide trends in service volumes. Then, they allow you to adjust those trends up and down. But there's a lot more to business planning than trends. There are two major reasons why these budget modules consistently lead to unhappy outcomes: inaccuracy, and their inability to support a healthy budget dialog.

AccuracyWhy would we believe that the future will be just like the past, plus or minus a few percent!? Cost and service-volume trends are just one input to business planning. But things change. Management judgment is required to:

Budget modules provide historic information (trends) that may fine-tune management judgment, but they're no substitute for a robust business planning process.

DialogPerhap more importantly, a budget projection based on spending trends does not support an effective budget dialog. The way budget discussions should go is this:

"Here's the list of things we did for you last year. Now, with growing volumes, here's what just that (just more of the same) will cost in the coming year. If any of those things aren't of value to you, let's cut them from the budget (and stop doing them)! "And remember the new things we've deployed for you this year? Well, here's what it will cost to sustain those things (keep them running) in the new year. "Note that our unit costs (rates) have come down. We're continually working to become more efficient. But with this increased volume of work, the total budget for next year has to go up just to do the same things we're doing for you this year. "Beyond that, here's the list of new things your staff are requesting, along with a few really intriguing investments our staff have suggested. I'm not sure they're all worth funding, but here's the true cost to shareholders/taxpayers/donors of each new project/service. "By the way, there's no 'fat' in these numbers. I've already gone over them, and this is what it will truly take to deliver these projects/services. "So let's discuss what you want to 'buy' in the coming year. That will tell us what the budget should be."

Budgets should be based on the needs of the business and the investment opportunities at hand. This has little to do with last year's spending. Even if the total budget is fixed (as a matter of affordability), don't get trapped into promising everything the business demands for last year's budget plus/minus an arbitrary percentage! A given level of budget only buys so much. Even when the total is predetermined, a healthy budget discussion engages the business in deciding what's funded and what they'll do without. This builds a mutual understanding of what customers can expect for a given level of funding (and what will require incremental funding if the business really wants it). No matter what the economic climate, you can't have a healthy budget dialog with just spending projections.

Your Approach Determines Your OutcomesIn fact, there's danger in projecting spending trends. It's a direct path to the infamous "do more with less" demand -- implying that you've been lazy about seeking efficiencies in the past, and when put under pressure, can simply stop wasting money. (You know that's not true. The truth is, you'll deliver less with less.) Budgets should be zero-based, and founded on a realistic forecast of demand for specific projects and services, and an honest estimate of the costs of delivering that plan. And budget negotiations should not be adversarial or political. They should be a fact-based dialog about what's expected of you in the coming year. In fact, those who benefit from your projects and services (your internal customers) should defend your budget. They're the one's who can best describe the value of your work, and they're the ones who will suffer if you're not funded to satisfy their needs. Of course, your customers can't vouch for your spending trends; but they can support specific projects and services that benefit them. To give executives the facts they need to make wise budget decisions, and to engage your customers in defending your budget, you need to know the specific deliverables planned for the coming year, and the cost of each. This is called "investment-based budgeting." In all likelihood, you've been budgeting based on spending forecasts for many years. This inevitably leads to a lack of understanding of the value you deliver; vague assertions that you cost too much; inadequate funding for innovation, infrastructure, and critical sustenance activities; absurd demands to do more with less; and customer expectations that far exceed your resources. If you want to change the outcomes, try a different approach. Investment-based budgeting is a practical solution to many common (and painful) resource-governance challenges.

|